By Carlos Dunlap-Beard

![]()

Carlos Dunlap-Beard is VP, Loyalty Solutions & Business Development at Snipp Interactive

Loyalty Marketing that leads to Customer Engagement remains top of mind for CMOs, Brand Managers and other marketing professionals. That’s good. What’s not so good is the fact that it has been on their minds for many years running, but the progress towards meaningful, measurable customer engagement has been slow within most organizations.

As a general rule in business and in life, what you are accountable for and measured against usually maintains a higher position on the priority list than objectives that are softer or nice to have. It would be in my best interest to shed 30 pounds; however, no one is holding me accountable for doing so and besides potential health concerns, there are no consequences if I maintain my current level of chunkiness. But finalizing the program design for a new client and getting this article to Snipp’s marketing department by the deadline, well let’s just say the former is a bad way to begin a new relationship and will erode trust, while the latter floods my inbox, makes me avoid eye contact with certain colleagues and probably gets my manager involved. I don’t need either of those consequences.

With that being said, I’m deeming 2018 The Year of Accountability!!!

- Implementing measurement and usable CRM Tools

There is a great deal that goes into this bucket. Everything from Reporting & Business Intelligence to Big Data & Campaign Management to Multichannel Marketing & Technology Integration is at play here. Success won’t be achieved by the organization with the most tools, but instead by the organization that makes the most out of the tools they have. For instance, if a retailer can distinguish my transactions from my neighbors by identifying us at the point of sale and has a MailChimp account, then based on my recent and past purchases, that retailer can send me a thank you note combined with an offer for a complimentary product to support my recent or past purchases. A similar note can be sent to my neighbor with offers based on her past behaviors. And to understand the impact of the message and offer, all the retailer has to do is to track whether or not I returned to purchase the featured complimentary product or responded to any other element of the offer.

Once that process is solidified and running efficiently, the retailer can add more dynamic elements to make it more automated and efficient.

At times, organizations don’t act because they want the 100% solution before implementing the strategy. Most of the time, a 75-80% solution will do the trick, plus it can be tweaked and enhanced periodically via process and efficiency improvements.

- Retaining, expanding and growing existing customers finally edges out acquisition

For far too long we have known that retaining and growing customers is less expensive than new customer acquisition; however, companies continue to direct a disproportionate amount of their marketing funds to acquisition efforts. 2018 is the year we finally flip the script on marketing allocations and focus on where the most significant opportunities reside… with existing customers. According to research by Invesp, a conversion rate optimization company, 44% of companies spend more marketing dollars on customer acquisition, while only 40% of companies have an equal focus on acquisition and retention even though 70% of the respondents agreed that it’s cheaper to retain than acquire a customer. Not only is it cheaper, but existing customers are 50% more likely to try new products from trusted brands and will spend 31% more than new customers.

As we enter the new year, we’re also going to begin a new way of approaching customer engagement and business growth. Through an emphasis on omni-channel and scalable technologies to either enhance existing loyalty programs, or turning a new leaf and developing loyalty from the ground up, tech solutions are the name of the game in 2018. Snipp has helped both longstanding loyalty players and brands in burgeoning businesses create impact amongst their existing customer bases.

- Employee training, recognition and empowerment is the spark that lights the fire that turbo charges the Customer Engagement Revolution

So many times great strategies have died during the execution stage of the project. Think about your own experiences as it relates to showing up in store, online or via phone to respond to an offer only to be let down because the company representative isn’t aware of the offer or understands it differently than you. Man, that sucks!

Although that does happen, it’s usually not the fault of the frontline associate. It’s usually a communications SNAFU and a lack of training. This is the dawn of Cultural Loyalty within companies, with an emphasis on employee communications, training, empowerment, and incentives. The overall goal for the organization and its newly enriched associates is to understand, drive and strengthen customer engagement. This can only be accomplished if those who interact with the customer most are aware, capable, and motivated.

As Richard Branson frequently quotes: “Clients do not come first. Employees come first. If you take care of your employees, they will take care of the clients.”

What Branson has known and implemented successfully across his Virgin enterprise, will be a big contributor to companies that differentiate themselves in 2018.

- Implementing and demonstrating a culture that cares.

Global, environmental, cultural and cause perspective is critical to today’s consumers. Organizations that ignore these factors will be challenged to stay relevant with an increasingly knowledgeable, empathetic, and vocal consumer.

Corporate philanthropy, green strategy and treatment of employees is almost as important as having a competitive or superior product. Consumers want to know that companies care as much about others as it cares about itself. For this reason, organizations like TOMS, WeWood and Warby Parker will continue to be relevant, positively impact the world and make profits. That’s one heck of a combination.

And finally, don’t be afraid to imbue these positive attitudes into the program itself. Loyalty strategies that help engage conscious consumers on the frontier of sustainability resonate strongly. Snipp has worked on a plethora of loyalty programs that actively promote sustainability efforts, including tying into charity programs and environmental causes.

- No more excuses.

It’s 2018. Although there are constant technology updates and totally new inventions debuting every day, there is very little regarding customer identification, behavior tracking and engagement that can’t be accomplished right now. Whereas some “grandfather” industries – Airlines, Hotels, Credit Cards – are looking for much needed evolutions in their outdated Loyalty Programs, categories such as Consumer Goods and Manufacturing, are just beginning their journeys into Customer Loyalty and Engagement.

Regardless of the industry, the technology exists to enable an evolution or open pathways and opportunities that were previously non-existent. In the early-to-mid 2000s, every financial institution was investing millions of dollars to launch their own proprietary credit card loyalty and rewards program. The conditions were ideal and the opportunities to influence consumers to use your card over another bank card was plentiful. Those programs generated millions of dollars of incremental profits.

Fast forward to 2018 and the conditions are perfect for Consumer Goods and Manufacturing with both B2C and B2B. These industries are no longer beholding to retailers or a research study to learn more about their customers. In the past, trying to free yourself from the clenched fist of the retailer meant tinkering with now-outdated solutions such as pin-on-pack. Novel technologies such as Snipp’s receipt processing solution, SnippCheck, means that your CPG brand can offer a tech-centric program that not only validates purchase, but is fun for the consumer to engage with. Now a strategy can be implemented to accomplish several goals, such as: end-user identification, data capture, social sharing/tracking, brand education, purchase tracking without POS integration, channel interactions, emotional monitoring, advocacy, and lifestyle inclusions. The toughest part for most organizations will be focus because there are plenty of squirrels that can create a distraction.

With the aforementioned in mind, as marketers who want to get smarter and be more relevant to customers and employees, all we must do is to settle on objectives, commit to a strategy, listen to customer feedback, enhance strategies/tactics as appropriate and measure outcomes to know where we can improve. That’s how we hold ourselves accountable. That’s how we make meaningful, measurable progress towards our goals.

Cheers to 2018!

Carlos Dunlap-Beard is VP, Loyalty Solutions & Business Development at Snipp Interactive.

The post Loyalty Marketing in 2018: What You Need to Know appeared first on The Wise Marketer.

Wise Marketer sponsor Maritz Motivation Solutions, a leading provider of loyalty programs to major companies and brands, has introduced decision sciences to the loyalty space, providing marketers with next generation insights to predict consumer behavior. Decision sciences combines traditional data analytics with behavioral science to uncover leading indicators so marketers can “read between the lines,” predicting customer defection before consumers even know they are thinking of disengaging, said Barry Kirk, vice president of loyalty solutions for Maritz Motivation Solutions.

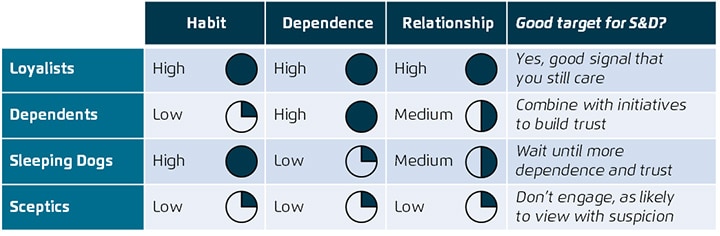

Wise Marketer sponsor Maritz Motivation Solutions, a leading provider of loyalty programs to major companies and brands, has introduced decision sciences to the loyalty space, providing marketers with next generation insights to predict consumer behavior. Decision sciences combines traditional data analytics with behavioral science to uncover leading indicators so marketers can “read between the lines,” predicting customer defection before consumers even know they are thinking of disengaging, said Barry Kirk, vice president of loyalty solutions for Maritz Motivation Solutions. Customer loyalty is arguably more important in business-to-business (B2B) industries than it is in consumer industries. That’s because, in B2B firms, the 80-20 rule is sometimes the 90-10 rule: the top 10 percent of your customers can account for 90 percent of your profits. The good news: by identifying the key purchasers and influencers in your client organizations and then building relationships with them that mimic relationships in the consumer world, you can increase the retention, yield, and lifetime value of your best customers. That’s the message from David Harwood, co-author of the Essential Guide to B2B Loyalty, published by the Wise Marketer. You can subscribe to the Guide here.

Customer loyalty is arguably more important in business-to-business (B2B) industries than it is in consumer industries. That’s because, in B2B firms, the 80-20 rule is sometimes the 90-10 rule: the top 10 percent of your customers can account for 90 percent of your profits. The good news: by identifying the key purchasers and influencers in your client organizations and then building relationships with them that mimic relationships in the consumer world, you can increase the retention, yield, and lifetime value of your best customers. That’s the message from David Harwood, co-author of the Essential Guide to B2B Loyalty, published by the Wise Marketer. You can subscribe to the Guide here.

Loyalty marketing is undergoing a period of revolutionary change – change that will require a new generation of leaders to evolve the industry to leverage today’s powerful analytical tools to build strong relationships with best customers. In this month’s sponsor spotlight, we ask new Maritz Motivation Solutions president Drew Carter about the transformation of loyalty from a marketing program to a strategic imperative that sits at the center of both the brand promise and the customer experience. His message: Watch out, because the pace of change will result in both unprecedented challenges and unmatched opportunities in the decade to come.

Loyalty marketing is undergoing a period of revolutionary change – change that will require a new generation of leaders to evolve the industry to leverage today’s powerful analytical tools to build strong relationships with best customers. In this month’s sponsor spotlight, we ask new Maritz Motivation Solutions president Drew Carter about the transformation of loyalty from a marketing program to a strategic imperative that sits at the center of both the brand promise and the customer experience. His message: Watch out, because the pace of change will result in both unprecedented challenges and unmatched opportunities in the decade to come. This month and all through October, we’re launching our Wise Marketer Spotlight series of white papers with the launch “Loyalty 3.0: The Future is Now” by rDialogue CEO Phil Rubin. To whet your appetite, we’re publishing this white paper preview to give you a taste of Phil’s insight. To download the complete white paper, go

This month and all through October, we’re launching our Wise Marketer Spotlight series of white papers with the launch “Loyalty 3.0: The Future is Now” by rDialogue CEO Phil Rubin. To whet your appetite, we’re publishing this white paper preview to give you a taste of Phil’s insight. To download the complete white paper, go

By Adam Schaffer, Managing Partner, Ellipsis & Company

By Adam Schaffer, Managing Partner, Ellipsis & Company

There is a discussion to be had on loyalty for the CPG industry; is the concept of a packaged goods brand having its own loyalty program still seen as an insurmountable summit? How have the historical barriers to loyalty establishment changed, if at all? In today’s landscape, consumer behaviors are shifting as rapidly as the approach brands take to marketing. The amalgamation of innovative technologies and proven strategies means that CPG loyalty programs – which were once denigrated as unwieldly and impractical – are finally beginning to blossom. Is it time for your brand to begin adopting loyalty? With 1st quarter 2017 CPG sales $3 billion lower than during the same period in 2016

There is a discussion to be had on loyalty for the CPG industry; is the concept of a packaged goods brand having its own loyalty program still seen as an insurmountable summit? How have the historical barriers to loyalty establishment changed, if at all? In today’s landscape, consumer behaviors are shifting as rapidly as the approach brands take to marketing. The amalgamation of innovative technologies and proven strategies means that CPG loyalty programs – which were once denigrated as unwieldly and impractical – are finally beginning to blossom. Is it time for your brand to begin adopting loyalty? With 1st quarter 2017 CPG sales $3 billion lower than during the same period in 2016